Your grocery bill keeps climbing. Your furniture costs more. That new appliance? Significantly pricier than last year.

There’s a reason behind these rising costs. It’s not just inflation. It’s something most Americans don’t see coming.

Tariffs are functioning as a hidden tax on American households. The average family paid $1,000 extra in 2025 because of these trade policies. That number is climbing to $1,300 in 2026.

The Numbers Don’t Lie

The Tax Foundation released shocking new research. This nonpartisan think tank analyzed the economic impact of current trade policies. Their findings paint a troubling picture.

American households absorbed an average tax increase of $1,000 in 2025. If current policies continue unchanged, that burden rises to $1,300 per household in 2026.

The federal government collected $264 billion in total tariff revenues during 2025. This represents the largest U.S. tax increase as a percentage of GDP since 1993.

That’s a 33-year record. The last time Americans faced such a dramatic tax hike was during the Clinton administration’s budget reconciliation efforts.

Who Really Pays for Tariffs?

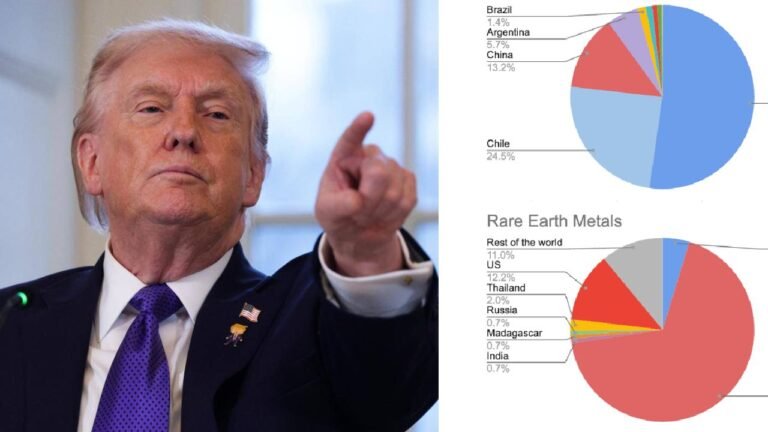

Political rhetoric often claims foreign countries pay tariffs. The data tells a different story. Research from the Kiel Institute for the World Economy examined over 25 million shipment records. These records covered more than $4 trillion in U.S. imports.

Their conclusion? Americans are paying 96% of tariff costs. Foreign exporters are absorbing only about 4%.

Julian Hinz serves as Research Director at the Kiel Institute. He co-authored the study. “The tariffs are an own goal,” he explained. “The claim that foreign countries pay these tariffs is a myth. The data show the opposite: Americans are footing the bill.”

Foreign exporters did not meaningfully reduce their prices in response to tariff increases. Instead, American importers paid higher duties. Those importers passed costs to retailers. Retailers passed them to consumers.

The $200 billion surge in customs revenue represents $200 billion extracted from American businesses and households.

How Tariffs Work in Practice

Understanding tariffs requires grasping a simple economic reality. When goods arrive at U.S. ports, importers must pay duties to customs officials. These are American companies paying American government officials.

The importer then faces a choice. Absorb the cost and accept lower profits. Or raise prices for customers.

Most businesses choose the latter. Especially in competitive markets with thin margins.

The result? Higher prices at checkout. Consumers pay more for the same products they bought last year.

Which Products Cost More?

Tariff impacts vary significantly by category. Some products saw dramatic price increases. Others experienced more modest changes.

Coffee prices rose 33.6% since December 2024. Ground beef climbed 19.3%. Romaine lettuce increased 16.8%. Orange juice concentrate jumped 12.4%. Even potato chips cost 7.3% more.

These aren’t abstract statistics. They’re real costs hitting American families every grocery trip.

Electronics faced substantial tariffs. Toys became more expensive. Cars and auto parts saw significant price hikes.

The furniture industry took a particularly hard hit. Tariffs on kitchen cabinets, bathroom vanities, and upholstered furniture reached 25% in late 2025. These rates were scheduled to increase further.

The Construction and Housing Impact

Homeowners looking to remodel faced sticker shock. New tariffs on construction materials drove up costs across the board.

Lumber tariffs hit 10% effective October 2025. Steel tariffs expanded significantly. The aluminum tariff rate doubled from 10% to 25%.

The National Association of Home Builders warned about consequences. Chairman Buddy Hughes stated, “These new tariffs will create additional headwinds for an already challenged housing market by further raising construction and renovation costs.”

The organization estimated that new residential construction utilized $204 billion worth of goods in 2024. Of this total, $14 billion were imported. That’s 7% of all materials used in new U.S. residential construction.

Tariffs on appliances also expanded. Dishwashers, refrigerators, washing machines, dryers, freezers, stoves, ovens, and food waste disposals all faced new duties.

Even Ikea acknowledged the impact. Tolga Öncü, retail manager at Ingka (which operates most Ikea stores), told The Wall Street Journal they couldn’t absorb all costs. “We can’t stay immune to absorb all the costs ourselves,” he admitted. Passing “part of the cost increase to the customers” became their new reality.

How Trade Policy Reached This Point

The administration used the International Emergency Economic Powers Act (IEEPA) to impose sweeping tariffs. This emergency law grants broad authority during national emergencies.

Tariffs targeted major trading partners. China faced the highest rates. Canada and Mexico also saw significant duties. The European Union wasn’t spared.

The weighted-average applied tariff rate on U.S. imports stood at 1.5% in 2022 according to World Bank data. With current tariffs in place, that figure jumped to 13.5%.

This represents nearly a tenfold increase in just three years. It’s the highest average tariff rate since 1946.

Excluding tariffs imposed through emergency powers, the rate would drop to 6.4% for 2026. But those emergency tariffs remain in place pending legal challenges.

The Supreme Court Question

The legality of IEEPA tariffs is now under Supreme Court review. Oral arguments took place in November 2025. Several justices expressed skepticism about the law’s scope.

Does IEEPA grant the president authority to impose such broad economic tariffs? Or does it only cover genuine national security emergencies?

The Court is currently in winter recess. February 20, 2026 is listed as the next scheduled session. A ruling could come soon after.

The outcome matters enormously. If the Court strikes down IEEPA tariffs, the estimated per-household cost would fall to $400 in 2026 according to Tax Foundation economist Alex Durante.

That’s a dramatic difference. $400 versus $1,300 represents $900 in potential savings per household.

Political and Economic Tensions

The tariff issue creates political challenges. Americans elected leadership promising to lower living costs. Instead, costs increased.

Manufacturing job losses added to the pain. The U.S. lost over 72,000 manufacturing jobs in 2025. This contradicted promises of a manufacturing boom.

Some companies received tariff waivers. Critics noted these often went to well-connected businesses. Meanwhile, ordinary Americans paid full freight.

Congressional efforts to address tariffs are moving forward. Some Republicans joined House Democrats to block measures that would have prevented challenges to the duties through July 31.

This bipartisan opposition signals growing discomfort with current policies.

Economic Impact Beyond Consumers

Tariffs don’t just hurt household budgets. They ripple through the entire economy.

The Tax Foundation projects that imposed tariffs will raise $2.0 trillion in revenue from 2026-2035 on a conventional basis. But they’ll also reduce U.S. GDP by 0.5%.

That’s before accounting for foreign retaliation. When other countries impose counter-tariffs on American exports, the damage multiplies.

Accounting for negative economic effects, the revenue raised falls to $1.6 trillion over the next decade. The economic cost reduces the net benefit substantially.

Real wages saw modest gains in 2025. But tariff-driven price increases ate into those gains. Many workers felt like they were running in place financially.

Business Response and Strategy

Businesses tried multiple strategies to cope with tariffs. Some absorbed costs initially. This protected customer relationships but hurt profit margins.

Others passed costs immediately to consumers. This maintained profitability but risked losing price-sensitive customers.

Many companies built massive inventory stockpiles early in 2025. They imported goods before anticipated tariff increases. This strategy worked temporarily.

But stockpiles eventually depleted. When businesses reordered, they paid higher tariff rates. Those costs had to go somewhere.

Kyle Peacock, principal at Peacock Tariff Consulting, noted the shift. “A lot of our clients really didn’t want to pass the costs on, but now they’re really having to,” he explained.

Many businesses planned price increases for early 2026. Some waited until the first or second quarter. But most acknowledged the inevitability.

JPMorgan estimated that businesses footed roughly 80% of the tariff bill in 2025. That proportion could shrink to just 20% later in 2026 as companies shift costs to consumers.

Sector-by-Sector Analysis

Different industries experienced tariff impacts differently. Grocers operate with thin profit margins. They have less ability to absorb costs. Food prices rose quickly.

The automotive sector saw significant disruption. Tariffs on imported parts increased production costs. Car prices climbed.

The electronics industry faced challenges. Many components come from overseas. Tariffs on semiconductors, displays, and other parts drove up device costs.

Fashion and apparel struggled. Clothing imports faced duties. Retailers raised prices to compensate.

Home goods and furniture suffered dramatically. High tariff rates on cabinets, vanities, and upholstered furniture created immediate price jumps.

The K-Shaped Consumer Economy

Not all consumers experienced tariff impacts equally. Higher-income households continued spending despite price increases. They have larger budgets and more flexibility.

Middle and lower-income households felt the squeeze acutely. Every price increase matters when budgets are tight.

Federal Reserve Bank of New York data shows the divergence. College graduates’ retail spending rose 6% from January 2023 to December 2025. Non-graduates’ spending increased only 4%.

This growing gap reflects economic inequality. Tariffs function as a regressive tax. They take a larger percentage of income from lower earners.

Luxury retailers maintained sales. Discount retailers like Walmart thrived by offering value. Mid-tier retailers struggled.

Inflation Connection

Tariffs contributed directly to inflation. Goldman Sachs economists estimated tariffs caused inflation to increase by half a percentage point in 2025.

Federal Reserve Chair Jerome Powell made a similar assessment. He stated last month that tariffs were responsible for the entirety of inflation’s rise above the central bank’s 2% target.

Inflation ended 2025 at 2.7%. Without tariffs, it would have been at or below the Fed’s goal.

Goldman anticipates inflation will increase by three-tenths of a percentage point in just the first six months of 2026. Tariffs drive this projection.

Rising inflation complicates Federal Reserve policy. The Fed wants to cut interest rates to support growth. But persistent inflation makes cuts risky.

Political Calculations

Midterm elections approach. Voters care deeply about living costs. High prices create political vulnerabilities.

Will leadership stay the course on tariffs? Or will they seek relief for struggling Americans?

History suggests flexibility. The administration reversed tariff threats many times in 2025. Wall Street even coined an acronym: TACO (Trump Always Chickens Out).

The administration rang in 2026 by delaying massive tariffs on furniture, cabinets, and Italian pasta. No clear explanation was provided. The last-minute reversal suggested concern about political backlash.

More quiet reversals may follow. Especially if consumer anger grows.

White House Defense

The White House rejected criticism of tariff programs. Spokesman Kush Desai pointed to broader economic indicators.

“America’s average tariff rate has increased by nearly tenfold in the past year,” Desai acknowledged in a statement to ABC News. “While inflation has actually cooled, real wages have risen, GDP growth has accelerated, and trillions in investments continue pouring in to make and hire in America.”

This defense emphasizes positive economic metrics. But it doesn’t address the direct cost to households.

Real wages did rise modestly. GDP growth remained solid. Investment flows continued.

However, these achievements don’t eliminate the $1,000 to $1,300 per-household tariff burden. Families still pay more at checkout regardless of macroeconomic trends.

Looking Forward to 2026

What should Americans expect in the coming year? More of the same, most likely.

Unless courts or Congress intervene, tariffs will remain. Costs will continue flowing to consumers.

The $1,300 average represents just that—an average. Some households will pay significantly more. Others may pay less depending on consumption patterns.

Families that buy imported goods frequently will feel the greatest impact. Those who can shift to domestic alternatives may reduce their burden.

But complete avoidance is impossible. Tariffs touch too many product categories.

Strategies for Consumers

Can families protect themselves from tariff costs? Options are limited but exist.

Buy domestic when possible. American-made products avoid tariffs. Though they’re often pricier for other reasons.

Stock up on durable goods before anticipated tariff increases. This worked for many in 2025.

Reduce discretionary spending. Focus budgets on essentials. Cut back on imports when feasible.

Shop at discount retailers. They often have better bargaining power and can offer lower prices.

Consider used or refurbished goods. These avoid tariffs applied to new imports.

The Broader Economic Debate

Economists largely agree on tariff effects. The consensus view holds that tariffs reduce economic efficiency.

Free trade increases economic output and income. Trade barriers do the opposite.

Historical evidence consistently shows tariffs raise prices and reduce available quantities of goods. This results in lower income, reduced employment, and lower economic output.

Some argue tariffs protect domestic industries. They create jobs in import-competing sectors. This benefit is real but limited.

The broader cost to consumers and the economy typically exceeds industry gains. The Tax Foundation and other research groups consistently find net negative effects.

The Path Forward

Three scenarios could play out in 2026. First, tariffs remain unchanged. Costs continue rising. Families pay $1,300 on average.

Second, courts strike down IEEPA tariffs. Costs fall dramatically to around $400 per household. This represents best-case for consumers.

Third, Congress acts to roll back tariffs. This seems less likely given political divisions. But growing bipartisan concern could enable action.

The most probable outcome? Some combination. Certain tariffs get reduced or eliminated. Others remain. The final cost falls somewhere between $400 and $1,300.

What This Means for Your Budget

For the average household, $1,300 is meaningful money. That’s more than a month of groceries for many families. It’s several tank fills of gas. It’s clothing for school kids.

This money doesn’t disappear into a void. It goes to the federal government as tariff revenue. The government then spends it on various priorities.

But from a household perspective, it’s money no longer available for other purposes. Families can’t save it. They can’t invest it. They can’t spend it on things they actually want.

It’s a forced transfer from consumer wallets to government coffers. And unlike income taxes, it hits regardless of ability to pay.

The Bottom Line

Americans are paying the price for current trade policies. The data is clear and consistent across multiple studies.

The average household bore a $1,000 burden in 2025. That rises to $1,300 in 2026 under current policies.

Claims that foreign countries pay tariffs don’t match reality. American importers pay duties. American consumers pay higher prices.

The Supreme Court may provide relief if it rules against IEEPA tariffs. Congress could act. Leadership could reverse course.

But absent intervention, families should plan for higher costs in 2026. Budget accordingly. Adjust spending. Prepare for the financial impact.

The $1,300 hidden tax is real. And it’s coming out of your wallet.