Global trade isn’t retreating. It’s reorganizing. Supply chains are stretching further, not shortening. Average trade distances hit record levels of 5,000 kilometers in 2026.

But who’s winning and losing? The map is being redrawn right now.

The U.S. Tariff Reality

The United States collected $287 billion in customs duties in 2025. That’s nearly triple the amount from 2024. Tariffs aren’t temporary. They’re permanent policy tools now.

Multiple layers of tariffs complicate import decisions. Section 301 targets China on unfair practices. Section 201 safeguards protect solar manufacturers. IEEPA emergency tariffs hit Canada, Mexico, and China.

The Supreme Court will rule on IEEPA tariff authority in early 2026. This decision could reshape everything. Companies are filing protective refund claims just in case.

Tariff policy remains volatile. What’s true today may change tomorrow. Businesses can’t plan assuming stability.

The New Winners Emerge

Developing countries outside major power blocs are thriving. Their combined global trade share rose from 42% in 2016 to 47% today.

India, Mexico, Vietnam, Brazil, and the UAE lead this shift. They benefit from companies diversifying away from China and toward more politically neutral locations.

Brazil became the biggest winner in agricultural trade. American soybean farmers lost as China shifted purchases. Brazil filled the gap immediately.

Italy’s rice imports to the U.S. became 12 percentage points cheaper relative to other suppliers. South African wine imports became 17 percentage points more expensive. These relative price shifts redistribute market share quietly but powerfully.

Europe Accelerates Trade Deals

Trump’s tariff threats accelerated European trade negotiations. Deals that stalled for decades suddenly completed.

The EU signed a partnership with South American Mercosur on January 17, 2026. Negotiations had dragged for 25 years. Tariff threats created urgency.

The EU and India concluded free trade agreement negotiations on January 27 after nearly two decades. Again, U.S. policy pressure drove completion.

Europe is building trade relationships precisely because America is building walls.

Supply Chain Regionalization

Global value chains aren’t disappearing. They’re reorganizing into regional hubs. Two-thirds of global trade occurs within value chains being reshaped by geopolitics.

Companies are moving from “just-in-time” to “just-in-case” inventory systems. Cost optimization gives way to risk management.

“Local-for-local” production expands rapidly. Firms build modular manufacturing closer to key markets. This mitigates tariff exposure and hedges currency risk.

Multinationals interviewed by the World Economic Forum report accelerating U.S.-based production investments. Geographic reallocation of capital expenditures is dramatic.

The Losers: Developing Economies

Developed economies appear less affected by tariff changes. Their earlier 1.5 percentage point advantage widened by roughly 2 points.

Developing economies saw their disadvantage grow from 1 to nearly 3 percentage points. Least developed countries went from neutral to facing a 2-point disadvantage.

Smaller, less diversified economies suffer most. They can’t absorb higher costs or redirect exports easily. Commodity-dependent nations risk fiscal strain.

Tariff changes also hurt value-chain advancement. Raw cocoa enters the U.S. duty-free. But chocolate tariffs rose significantly and unevenly. Major exporters like Belgium and Switzerland face smaller increases than cocoa-producing Ghana or Ivory Coast.

Trade Distance Paradox

Despite regionalization talk, trade distances reached new records. Supply chains are actually stretching further, not contracting.

How? Firms are diversifying suppliers across more countries. A company might source from Vietnam, Mexico, and Poland instead of just China.

Each individual supplier might be farther away. But redundancy and diversification drive the pattern. Resilience trumps efficiency.

The Role of AI and Technology

AI is reshaping trade flows. Companies use machine learning for real-time tariff calculation. Automated systems track 10-digit classification codes across 180+ countries.

Technology helps businesses comply with constantly shifting rules. Manual processes can’t keep pace. Avalara Cross-Border delivers automatic updates using AI-driven classification.

Digital trade continues thriving. The U.S. maintains a surplus in services trade, especially digital services. This offsets goods trade deficits partially.

Environmental Rules Tighten

Environmental, social, and security-driven rules expand in 2026. The EU’s carbon border mechanism takes full effect. Clean-energy industrial policies reshape market access.

These rules impact developing countries hardest. Compliance costs fall unevenly. Smaller exporters and lower-income economies struggle most.

Flexible rules and targeted assistance become critical. Without support, inclusive trade becomes impossible.

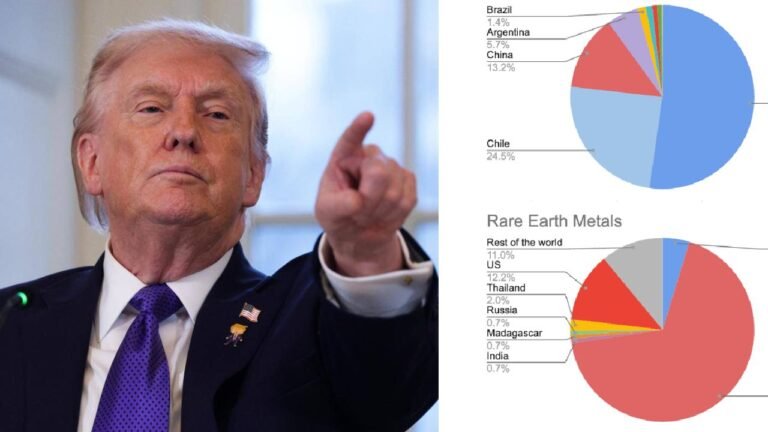

Critical Minerals Shift

Clean-energy mineral prices fell 18-39% below 2021-22 peaks. Oversupply and slower battery demand drove declines. Technological shifts reduce mineral intensity.

Lower prices ease EV and renewable costs. But investment suffers. Mining investment growth slowed from 30% in 2022 to 5% in 2024.

Export controls tightened dramatically. The Democratic Republic of Congo restricted cobalt. China controlled rare earths. Supply risks remain despite lower prices.

What Businesses Must Do

Stop assuming stability. Trade policy is volatile and politically driven. Plans must include multiple scenarios.

Diversify supplier bases immediately. Single-source dependencies are existential risks. Build relationships in multiple regions.

Use technology for compliance. Real-time duty calculation and classification prevent costly errors. Manual systems can’t keep pace.

Monitor relative tariff positions closely. Your competitors might face different rates. Small advantages compound over time.

The Bottom Line

Global trade isn’t dying. It’s evolving. New routes emerge as old ones close. New winners rise as established players struggle.

India, Mexico, Vietnam, Brazil, and the UAE are capturing market share. China is pivoting exports to non-U.S. markets. Europe is accelerating trade deals.

Businesses that adapt quickly will thrive. Those that assume “normal” will return will fail. The 2026 trade landscape rewards agility above all else.